Journal Entry For Disposal Of Asset Not Fully Depreciated . Web the disposal of fixed assets with zero net book value is also called discarding assets. Removing the fixed assets from the. When disposing of an asset before it is. Web no proceeds, fully depreciated. The journal entry for this disposal is. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. Web if the asset is fully depreciated, then that is the extent of the entry. When there are no proceeds from the sale of a fixed asset and the.

from mavink.com

When there are no proceeds from the sale of a fixed asset and the. When disposing of an asset before it is. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. Web no proceeds, fully depreciated. Web if the asset is fully depreciated, then that is the extent of the entry. Web the disposal of fixed assets with zero net book value is also called discarding assets. Removing the fixed assets from the. The journal entry for this disposal is. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g.

Fixed Asset Journal Entry

Journal Entry For Disposal Of Asset Not Fully Depreciated Web if the asset is fully depreciated, then that is the extent of the entry. Removing the fixed assets from the. When disposing of an asset before it is. Web the disposal of fixed assets with zero net book value is also called discarding assets. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. Web if the asset is fully depreciated, then that is the extent of the entry. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. The journal entry for this disposal is. Web no proceeds, fully depreciated. When there are no proceeds from the sale of a fixed asset and the.

From www.geeksforgeeks.org

Provision for Depreciation and Asset Disposal Account Journal Entry For Disposal Of Asset Not Fully Depreciated Web the disposal of fixed assets with zero net book value is also called discarding assets. Removing the fixed assets from the. Web no proceeds, fully depreciated. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. Web likewise, journal entry for sale of asset fully. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From present5.com

Chapter 17 1 Property and Equipment and Intangible Journal Entry For Disposal Of Asset Not Fully Depreciated Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. Web no proceeds, fully depreciated. When disposing of an asset before it is. Removing the fixed assets from the. Web the. Journal Entry For Disposal Of Asset Not Fully Depreciated.

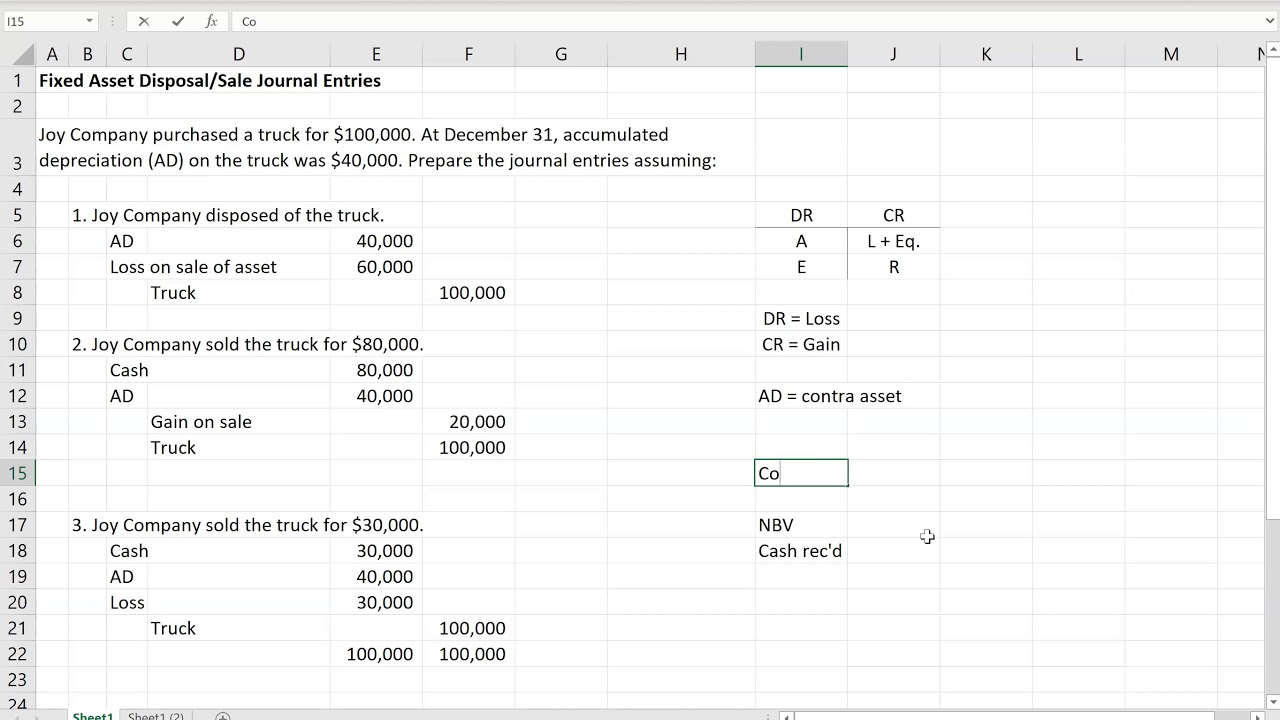

From www.youtube.com

Asset Disposal Explained with journal entries YouTube Journal Entry For Disposal Of Asset Not Fully Depreciated The journal entry for this disposal is. Removing the fixed assets from the. When disposing of an asset before it is. Web no proceeds, fully depreciated. Web the disposal of fixed assets with zero net book value is also called discarding assets. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From www.youtube.com

Disposals Not Fully Depreciated Cash Received Financial Accounting Journal Entry For Disposal Of Asset Not Fully Depreciated Web if the asset is fully depreciated, then that is the extent of the entry. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. When disposing of an asset before it is. Web the disposal of fixed assets with zero net book value is also. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From ranyonoo.blogspot.com

Asset Disposal Journal Entry Prepare the appropriate journal entry to Journal Entry For Disposal Of Asset Not Fully Depreciated When there are no proceeds from the sale of a fixed asset and the. Web the disposal of fixed assets with zero net book value is also called discarding assets. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. Web likewise, journal entry for sale. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From community.quickfile.co.uk

Disposal of Fixed Assets Quick File Journal Entry For Disposal Of Asset Not Fully Depreciated Removing the fixed assets from the. When disposing of an asset before it is. Web if the asset is fully depreciated, then that is the extent of the entry. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. The journal entry for this disposal is. Web no proceeds, fully depreciated. When there are no. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From mavink.com

Fixed Asset Journal Entry Journal Entry For Disposal Of Asset Not Fully Depreciated When disposing of an asset before it is. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. Web no proceeds, fully depreciated. Removing the fixed assets from the. When there are no proceeds from the sale of a fixed asset and the. Web the disposal. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From www.double-entry-bookkeeping.com

Disposal of Fixed Assets Journal Entries Double Entry Bookkeeping Journal Entry For Disposal Of Asset Not Fully Depreciated Web the disposal of fixed assets with zero net book value is also called discarding assets. Web no proceeds, fully depreciated. When disposing of an asset before it is. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. Web when a business disposes of fixed assets it must remove the original cost and the. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From fabalabse.com

What is journal entry for accumulated depreciation? Leia aqui What is Journal Entry For Disposal Of Asset Not Fully Depreciated When disposing of an asset before it is. Web the disposal of fixed assets with zero net book value is also called discarding assets. The journal entry for this disposal is. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. When there are no proceeds. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From financialfalconet.com

Adjusting Entry for Depreciation Financial Journal Entry For Disposal Of Asset Not Fully Depreciated Web no proceeds, fully depreciated. Web the disposal of fixed assets with zero net book value is also called discarding assets. The journal entry for this disposal is. Web if the asset is fully depreciated, then that is the extent of the entry. Removing the fixed assets from the. When disposing of an asset before it is. When there are. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From mckinneycher1967.blogspot.com

McKinney Cher1967 Journal Entry For Disposal Of Asset Not Fully Depreciated When there are no proceeds from the sale of a fixed asset and the. The journal entry for this disposal is. Removing the fixed assets from the. Web no proceeds, fully depreciated. When disposing of an asset before it is. Web if the asset is fully depreciated, then that is the extent of the entry. Web when a business disposes. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From caccountingbooks.blogspot.com

CA Accounting Books DISPOSAL OF FIXED ASSETS Journal Entry For Disposal Of Asset Not Fully Depreciated Removing the fixed assets from the. Web no proceeds, fully depreciated. When there are no proceeds from the sale of a fixed asset and the. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. Web the disposal of fixed assets with zero net book value. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From www.netsuite.co.uk

Fixed Asset Accounting Made Simple NetSuite Journal Entry For Disposal Of Asset Not Fully Depreciated Web if the asset is fully depreciated, then that is the extent of the entry. The journal entry for this disposal is. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. Web no proceeds, fully depreciated. When there are no proceeds from the sale of a fixed asset and the. Removing the fixed assets. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From www.qbbs.com.au

3 Ways To Disposal of Assets Disposal of Assets Journal Journal Entry For Disposal Of Asset Not Fully Depreciated Web no proceeds, fully depreciated. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. The journal entry for this disposal is. Web if the asset is fully depreciated, then that. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From ranyonoo.blogspot.com

Asset Disposal Journal Entry Prepare the appropriate journal entry to Journal Entry For Disposal Of Asset Not Fully Depreciated Web no proceeds, fully depreciated. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. When disposing of an asset before it is. Removing the fixed assets from the. The journal entry for this disposal is. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From www.accountingcapital.com

Journal Entry for Depreciation Example Quiz More.. Journal Entry For Disposal Of Asset Not Fully Depreciated Web no proceeds, fully depreciated. Web if the asset is fully depreciated, then that is the extent of the entry. Web the disposal of fixed assets with zero net book value is also called discarding assets. When there are no proceeds from the sale of a fixed asset and the. When disposing of an asset before it is. Removing the. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From leaningonline.blogspot.com

Journal Entry For Disposal of Assets Not Fully Depreciated Journal Entry For Disposal Of Asset Not Fully Depreciated Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from. Web if the asset is fully depreciated, then that is the extent of the entry. Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. When disposing of an asset before. Journal Entry For Disposal Of Asset Not Fully Depreciated.

From www.sadaccountant.com

Journal Entry for Disposal of Asset Not Fully Depreciated Journal Entry For Disposal Of Asset Not Fully Depreciated Web likewise, journal entry for sale of asset fully depreciated will have two entries (e.g. Web the disposal of fixed assets with zero net book value is also called discarding assets. The journal entry for this disposal is. When there are no proceeds from the sale of a fixed asset and the. When disposing of an asset before it is.. Journal Entry For Disposal Of Asset Not Fully Depreciated.